Problem/goal

A recommitment and renewed focus by executive leadership necessitated a relaunch of our year-old managed wifi product offering. The previous launch had not been successful and the goal was to relaunch the product (tier 1 launch) using the learnings from the prior failed launch. I won’t disclose specifics out of respect to my previous employer, but metrics were set to use as a north star for the product relaunch.

My role

As Product Marketing Manager assigned to the Community WiFi product off and on during the run-up and initial launch, I was tasked to work with a newly hired coworker to tag-team the relaunch of the product. To start, we initiated a research project to help us identify needed areas of improvement. I worked on all facets of the project, ranging from strategy down to execution of the actual work which included sourcing image assets, generating copy for the 6 pages, and bundling it for the web team to create the pages in the staging environment for review (before pushing them live).

Strategy/process

We received budget for a post-mortem research project using a 3rd party provider to conduct interviews with a number of existing and potential clients (mainly REITs and mid-market companies). We debriefed the 3rd party provider and shared our reasons for the launch failure. With their assistance, we generated a questionnaire that this company would conduct to gather anonymous qualitative feedback to use as a data point to help us proceed with added confidence to address our product offering’s issues.

One of the key takeaways from the report was that the Community Wifi webpage was insufficient in providing enough detail, credibility, value, and differentiation. The unique selling proposition was not clearly communicated, and a lack of overall credibility and confidence arose from those who viewed the high-level page. Additional detail was needed to help prospects and clients credibly view our company as being able to deliver value in this new vertical.

Deliverables

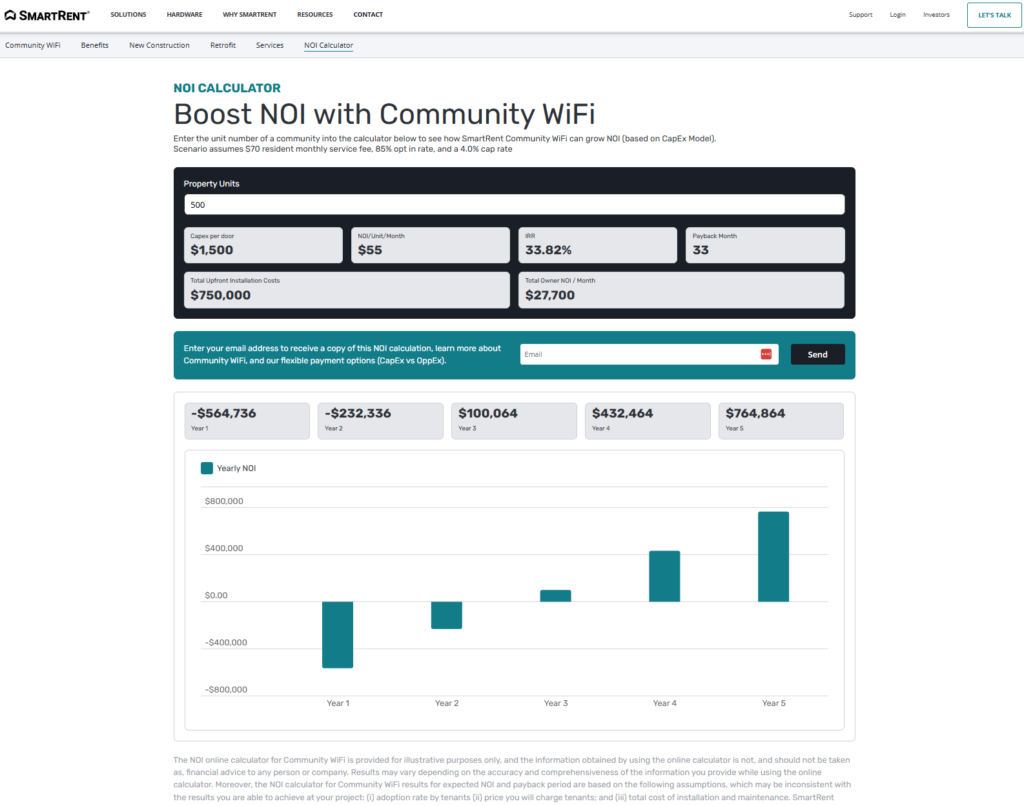

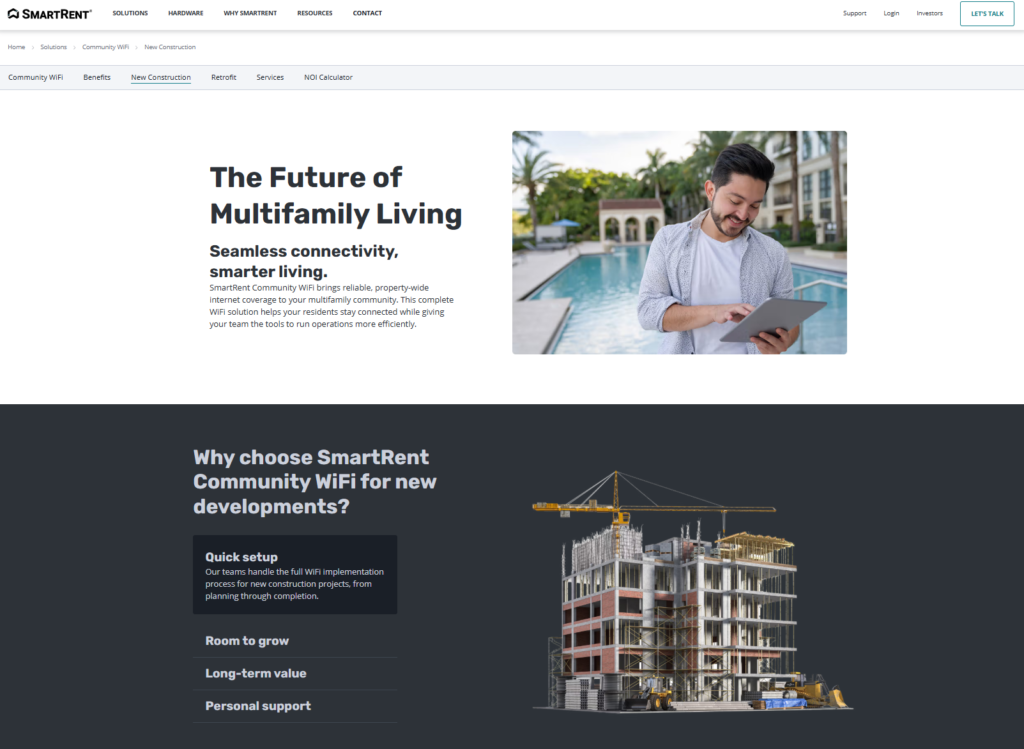

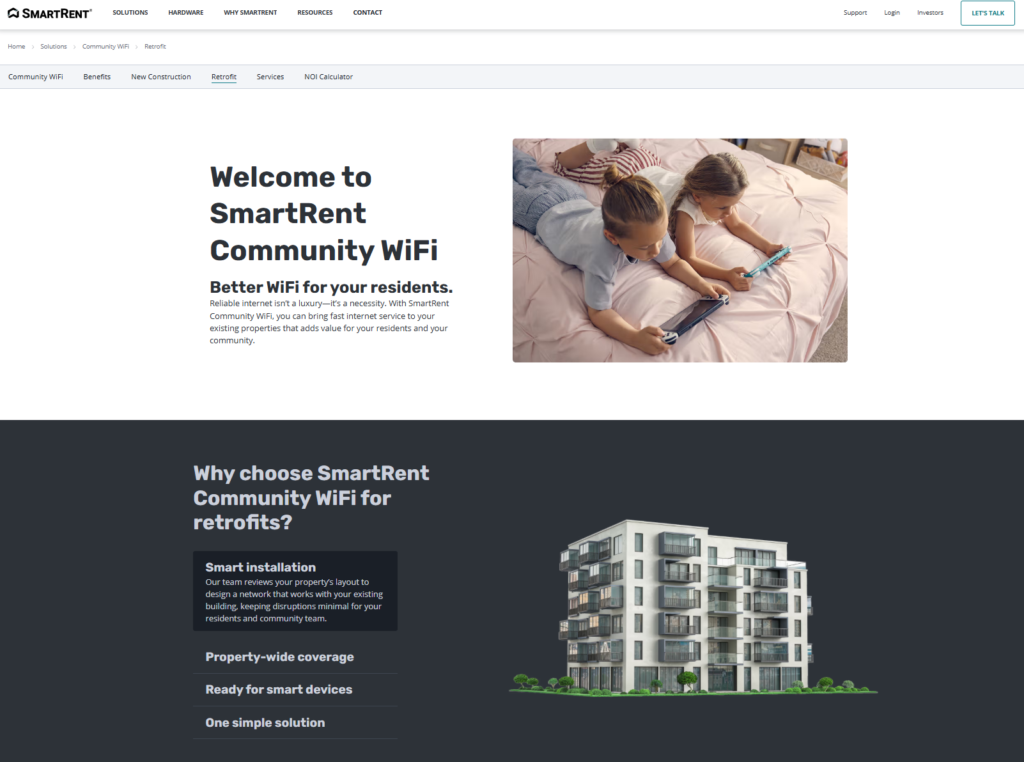

A part of our plan to address this feedback was to build a 5-page microsite that better highlighted our unique selling proposition (drastic NOI bump due to unique business model via an NOI Calculator) and increased our credibility in this new space. We updated the main feeder page with proof points, guided demos, and a clear path to 5 new pages that addressed new builds vs retrofits, benefits, on-going service, and financial modeling through an interactive NOI calculator to help interested parties see how fruitful SmartRent’s managed wifi offering was to their bottom line. While there were typical call-to-action buttons collecting Marketing Qualified Leads (MQLs), the NOI calculator’s lead form and resulting MQLs armed our sales team with higher quality leads that had been exposed to our key differentiator (the boost to NOI of our product vs what was typical in that market).

Links to the current live webpages are embedded in the paragraph above.

Results

I don’t have long-term data on the success of this initiative, as the microsite was launched only a few months before parting ways with this employer, but we were seeing a significant increase in leads submitted and conversations being started between clients and their assigned Account Managers. Also, the change in CEO and recalibration of priorities resulted in this relaunch being deprioritized. Feedback with the involved team members from within the company was overwhelmingly positive. Several noted that had we launched originally with this resource, it would have made a significant difference in the adoption/reception of the product.